Secure Your Comfort With Reliable Home Insurance Coverage

Why Home Insurance Is Essential

The value of home insurance coverage hinges on its ability to supply financial security and peace of mind to house owners in the face of unanticipated events. Home insurance policy serves as a safeguard, offering insurance coverage for problems to the physical structure of the residence, personal items, and obligation for crashes that might happen on the residential property. In case of natural disasters such as earthquakes, floodings, or fires, having a comprehensive home insurance policy can help house owners reconstruct and recoup without facing significant monetary problems.

In addition, home insurance is usually required by home loan lending institutions to protect their financial investment in the building. Lenders wish to make certain that their financial passions are secured in situation of any damages to the home. By having a home insurance coverage in place, homeowners can accomplish this need and protect their financial investment in the building.

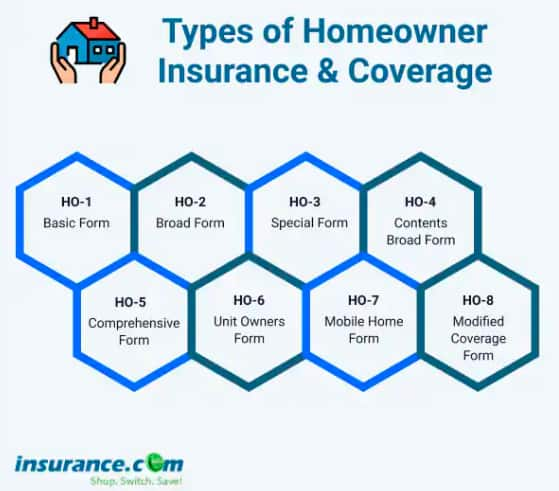

Sorts Of Protection Available

Given the importance of home insurance policy in shielding homeowners from unexpected financial losses, it is crucial to understand the different kinds of insurance coverage readily available to tailor a plan that suits individual requirements and scenarios. There are a number of crucial kinds of coverage provided by the majority of home insurance policy policies. Personal home insurance coverage, on the various other hand, safeguards possessions within the home, consisting of furnishings, electronic devices, and clothes.

Factors That Influence Premiums

Variables affecting home insurance coverage costs can vary based on a variety of factors to consider specific to specific circumstances. One significant variable impacting costs is the area of the insured residential or commercial property. Residences in areas vulnerable to all-natural disasters such as quakes, wildfires, or cyclones generally draw in greater costs due to the enhanced danger of damages. The age and condition of the home also play a crucial duty. Older homes or residential properties with out-of-date electric, pipes, or furnace may posture higher dangers for insurance coverage business, resulting in higher premiums.

In addition, the insurance coverage restrictions and deductibles picked by the policyholder can influence the premium amount. Choosing higher protection limits or lower deductibles generally causes greater costs. The type of building materials utilized in the home, such as wood versus block, can additionally affect premiums as specific products may be a lot more prone to damages.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Just How to Pick the Right Plan

Selecting the proper home insurance coverage entails cautious factor to consider of different vital aspects to make sure thorough coverage customized to individual needs and situations. To begin, examine the value of your home and its contents precisely. Understanding the replacement price of your home and items will certainly help establish the protection restrictions called for in the plan. Next, consider the different kinds of insurance coverage available, such as dwelling coverage, personal residential property insurance coverage, responsibility defense, and extra living costs coverage. Dressmaker these coverages to match your details demands and risk variables. In addition, evaluate the plan's deductibles, limits, and exclusions to ensure they line up with your economic capacities and risk tolerance.

Additionally, examining the insurance policy business's credibility, economic security, client service, and declares procedure is important. Look for insurance companies with a history of dependable solution and punctual insurance claims settlement. Contrast quotes from multiple insurance firms to find a balance between cost and insurance coverage. useful reference By thoroughly reviewing these factors, you can select a home insurance plan that offers the essential security and comfort.

Benefits of Reliable Home Insurance Coverage

Trusted home insurance supplies a complacency and defense for property owners against monetary losses and unexpected events. Among the essential benefits of reliable home insurance coverage is the guarantee that your residential or commercial property will be covered in case of damage or damage brought on by natural catastrophes such as fires, floods, or tornados. This insurance coverage can assist homeowners prevent bearing the full expense of repair services or rebuilding, supplying satisfaction and financial security throughout tough times.

In addition, dependable home insurance coverage policies typically consist of obligation security, which can guard house owners from legal and clinical expenditures in the instance of accidents on their residential or commercial property. This protection expands beyond the physical structure of the home to shield against legal actions and insurance claims that may occur from injuries received by site visitors.

Moreover, having trustworthy home insurance policy can additionally add to a feeling of general health, recognizing that your most substantial financial investment is protected versus different threats. By paying regular premiums, house owners can alleviate the potential monetary worry of unexpected occasions, enabling them to concentrate on appreciating their homes without continuous fret about what could take place.

Final Thought

In conclusion, protecting a reliable home insurance plan is important for securing find out this here your residential property and possessions from unforeseen occasions. By recognizing the sorts of protection readily available, aspects that influence premiums, and how to select the right policy, you can guarantee your comfort. Trusting in a reputable home insurance policy supplier will certainly use you the benefits of financial protection and protection for your most valuable asset.

Browsing the realm of home insurance coverage can be complex, with different coverage alternatives, policy factors, and considerations to consider. Recognizing why home insurance is vital, the types of coverage readily available, and exactly how to choose the appropriate policy can be essential in guaranteeing your most considerable investment stays secure.Provided the importance of home insurance in safeguarding house owners from unexpected economic losses, it is essential to understand the numerous kinds of insurance coverage readily available to customize a policy that matches specific demands and circumstances. San Diego Home Insurance. There are a number of vital kinds of insurance coverage supplied by many home insurance policy policies.Picking the proper home insurance policy includes cautious factor to consider of various vital elements to ensure read the full info here extensive insurance coverage tailored to private needs and conditions